Unlock the Advantages of Engaging Debt Specialist Services to Navigate Your Course In The Direction Of Financial Debt Relief and Financial Flexibility

Engaging the services of a financial debt professional can be a crucial action in your trip towards achieving debt alleviation and economic security. These experts offer tailored approaches that not just evaluate your distinct economic conditions however also provide the essential advice needed to browse complicated settlements with creditors. Recognizing the diverse benefits of such proficiency might expose options you had not previously taken into consideration. Yet, the concern remains: what certain advantages can a financial debt specialist offer your monetary situation, and just how can you determine the appropriate partner in this undertaking?

Recognizing Financial Obligation Professional Services

Financial debt professional solutions supply specialized support for people grappling with monetary difficulties. By examining your earnings, financial obligations, and expenses, a debt consultant can help you recognize the origin triggers of your monetary distress, allowing for a more accurate approach to resolution.

Financial debt consultants usually utilize a multi-faceted method, which may consist of budgeting aid, arrangement with lenders, and the advancement of a strategic settlement strategy. They function as intermediaries in between you and your financial institutions, leveraging their know-how to discuss much more favorable terms, such as lowered passion rates or extended settlement timelines.

Additionally, debt professionals are furnished with up-to-date expertise of pertinent legislations and regulations, making certain that you are notified of your civil liberties and choices. This specialist assistance not just minimizes the emotional problem related to financial debt however additionally equips you with the devices needed to reclaim control of your financial future. Inevitably, engaging with financial obligation consultant services can bring about a more organized and informed path toward economic stability.

Secret Advantages of Professional Assistance

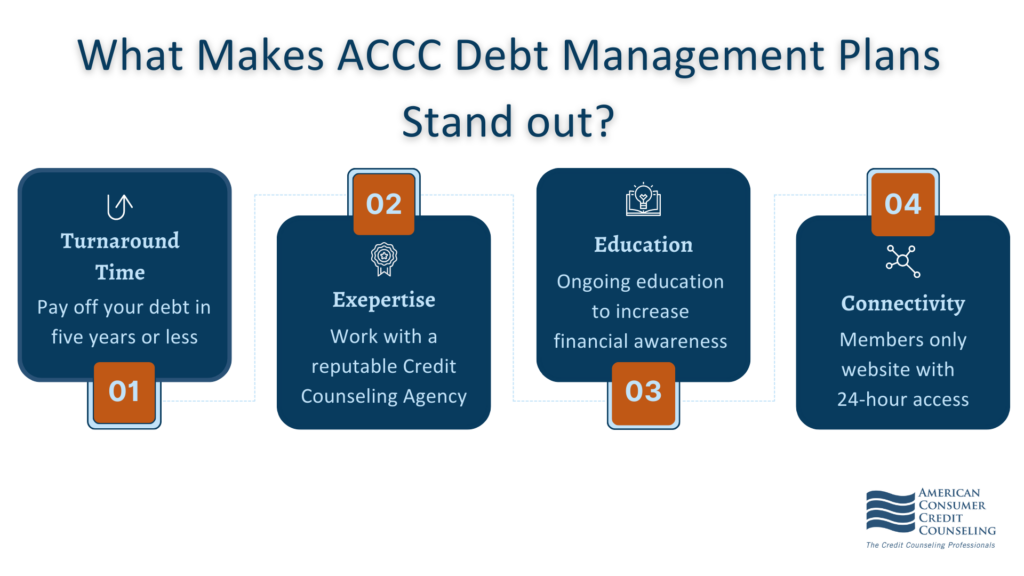

Involving with debt expert solutions presents various benefits that can significantly enhance your economic scenario. One of the key benefits is the knowledge that professionals give the table. Their substantial understanding of financial debt management strategies permits them to customize services that fit your special circumstances, guaranteeing a much more efficient strategy to attaining financial stability.

In addition, financial debt consultants frequently supply settlement help with financial institutions. Their experience can bring about extra favorable terms, such as reduced rates of interest or settled debts, which may not be achievable via straight arrangement. This can cause considerable monetary relief.

Furthermore, consultants offer an organized strategy for settlement, assisting you prioritize debts and allocate sources successfully. This not just simplifies the repayment process yet additionally promotes a sense of liability and progression.

Ultimately, the mix of specialist support, settlement skills, structured repayment strategies, and emotional support placements financial debt experts as important allies in the pursuit of financial obligation relief and economic flexibility.

How to Pick the Right Expert

When choosing the right financial debt expert, what essential factors should you take into consideration to make sure a positive result? First, analyze the expert's qualifications and experience. debt consultant services singapore. Seek accreditations from recognized companies, as these indicate a degree of professionalism and reliability and expertise in the red management

Next, take into consideration the specialist's reputation. Research study on-line evaluations, endorsements, and ratings to determine previous clients' contentment. A strong record of effective debt resolution is necessary.

Additionally, examine the professional's method to debt management. A good specialist ought to supply personalized solutions customized to your special financial situation instead than a one-size-fits-all remedy - debt consultant services singapore. Transparency in their processes and charges is essential; ensure you comprehend the original site prices entailed prior to committing

Communication is one more essential aspect. Pick a professional that is approachable and ready to address your inquiries, as a strong working partnership can boost your experience.

Usual Financial Debt Alleviation Strategies

While numerous financial debt alleviation approaches exist, picking the appropriate one relies on specific economic conditions and objectives. A few of the most common techniques include debt loan consolidation, financial debt monitoring strategies, and financial debt negotiation.

Debt combination includes combining numerous financial debts right into a single car loan with a lower rates of interest. This technique simplifies settlements and can lower regular monthly responsibilities, making it easier for people to gain back control of their funds.

Financial debt administration strategies (DMPs) are created by credit history counseling companies. They bargain with financial institutions to reduced rates of interest and create an organized layaway plan. This alternative allows people to pay off financial obligations over a set period while profiting from specialist assistance.

Financial debt settlement requires bargaining directly with lenders to resolve debts for less than the overall quantity owed. While this strategy can offer instant alleviation, it might impact credit report and frequently includes a lump-sum settlement.

Lastly, bankruptcy is a legal choice that can supply remedy for frustrating debts. However, it has long-lasting monetary effects and need to be considered as a last resource.

Selecting the suitable method needs cautious examination of one's economic scenario, making certain a customized strategy to attaining lasting security.

Actions In The Direction Of Financial Flexibility

Next, establish a reasonable budget that focuses on basics and fosters savings. This budget should consist of stipulations for financial debt settlement, permitting you to designate excess funds efficiently. Complying with a budget helps grow disciplined spending habits.

As soon as a spending plan remains in location, consider involving a financial debt expert. These experts provide tailored approaches for handling and decreasing debt, giving understandings that can accelerate your journey towards monetary freedom. They might recommend options such as financial debt combination or negotiation with financial institutions.

In addition, focus on developing an emergency situation the original source fund, which can protect against future economic strain and supply peace of mind. Together, these actions debt consultant with EDUdebt develop a structured technique to attaining financial flexibility, changing aspirations right into fact.

Conclusion

Engaging financial debt consultant services uses a strategic method to accomplishing financial debt relief and financial flexibility. These specialists give vital support, customized strategies, and emotional support while making sure conformity with pertinent laws and regulations. By prioritizing financial obligations, discussing with financial institutions, and applying organized repayment plans, individuals can regain control over their financial circumstances. Eventually, the know-how of financial debt consultants considerably boosts the chance of browsing the intricacies of financial obligation administration successfully, causing an extra safe monetary future.

Involving the services of a financial debt expert can be a critical step in your trip towards attaining financial obligation relief and economic stability. Debt expert services supply specialized support for individuals grappling with economic challenges. By analyzing your earnings, debts, and costs, a debt expert can help you recognize the root creates of your financial distress, enabling for a more precise approach to resolution.

Engaging financial debt specialist solutions offers a calculated approach to accomplishing financial debt relief and monetary liberty. Ultimately, the experience of debt experts significantly improves the chance of navigating the complexities of financial obligation monitoring properly, leading to a much more protected monetary future.